Solana price predictions for 2025, 2026 and 2030

After nearly disappearing from the cryptocurrency map following the collapse of the FTX exchange in 2022, Solana has made a strong comeback to become one of the most important blockchain systems in the Web 3 space. Solana uses a unique layer based on proof of history, enabling it to verify hundreds of thousands of transactions per second, and it appears to have finally solved the problem of frequent outages.

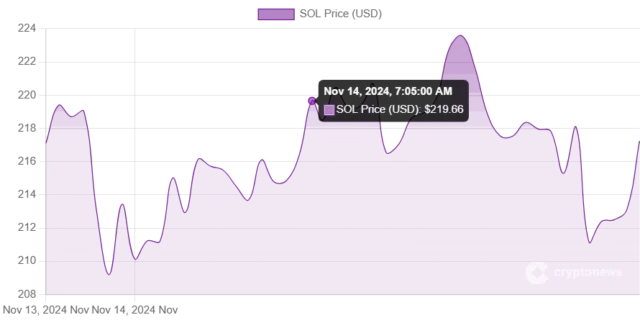

As of November 14, 2024, Solana’s price is trading at $214.91, on track to reach an all-time high of $259.52. Here’s some quick data on Solana’s current performance:

In this Solana price prediction, we review Solana’s price history and uncover what happened in the past, before delving into the future to provide SOL price forecasts for each year between 2025 and 2030.

Solana SOL Price Prediction Overview

Solana (SOL) was first launched in 2017 and uses a unique proof-of-stake concept, allowing it to process transactions at a speed of up to 700,000 transactions per second.

The network was launched in 2020 and recorded its first price of $0.9511. Despite its technical capabilities, Solana has experienced several network outages each year since its launch, but the price impact of these outages has been minimal.

Solana reached its all-time high (ATH) of $259.52 on November 6, 2021, during a broad market rally. However, in 2022, the price of $SOL declined due to multiple outages, bearish market conditions, and the collapse of FTX and Alameda Research , two exchanges closely associated with Solana.

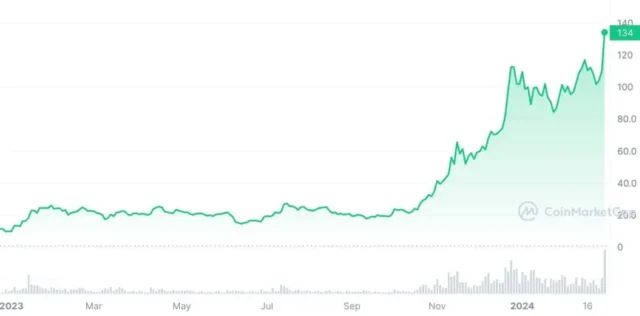

After many declared Solana’s end at the end of 2022, it made a stunning comeback in 2023, rising from less than $10 at the start of the year to close at $109.55, a 997% increase. Solana continued its gains in 2024, with the price of $SOL reaching $195.99 in March.

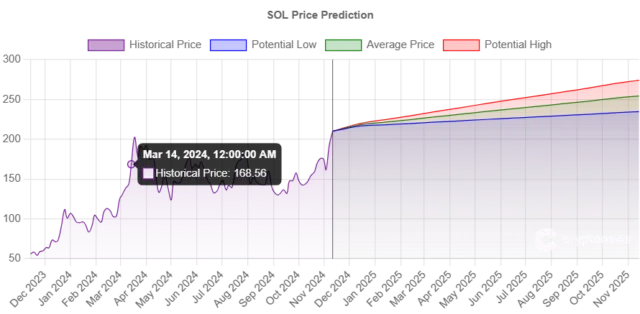

We expect Solana price to reach a new high of $306.78 in 2025 thanks to the impact of the Bitcoin halving .

Solana could reach a high of $1,111.22 in 2030, trading at an average price of $674.46 by the end of the decade.

The table below shows our Solana price forecast for each year until 2030.

Solana Price Prediction 2025-2030

| highest price | Average price | Minimum price | year |

| $306.78 | $276.15 | $245.53 | 2025 |

| $424.23 | $346.62 | $276.85 | 2026 |

| $567.86 | $424.79 | $308.03 | 2027 |

| $735.19 | $508.08 | $338.16 | 2028 |

| $919.85 | $592.83 | $366.22 | 2029 |

| $1,111.22 | $674.46 | $391.22 | 2030 |

Solana Price Prediction 2025-2030

In the following sections, we delve into our Solana price predictions for each year remaining in this decade, explaining the reasons behind our conclusions for each year.

Solana Price Prediction 2025

If 2024 was the year of the Bitcoin halving, then 2025 is the year many expect Bitcoin to reach new record highs, potentially driving the rest of the market higher. Analysts predict that the price of Bitcoin (BTC) will reach $200,000, which will have a significant impact on the price of SOL (SOL) and other altcoins .

2025 is also the year we are expected to see some regulatory clarity on cryptocurrencies in some of the world’s largest economies, following 2024, which propelled cryptocurrencies into the mainstream. This is a major positive step. The US Congress appears poised to pass cryptocurrency-related legislation after the November elections, and the new presidential administration may be more supportive of cryptocurrencies.

Based on this, our Solana price prediction for 2025 is as follows:

- Potential high price for 2025: $306.78.

- Average price in 2025: $276.15.

- Possible low price for 2025: $245.53.

SOL Price Prediction 2026

If the Bitcoin halving is expected to peak in 2025, 2026 is the year in which the consequences of this event are expected to occur. However, these consequences will be supported by the global improvement in the regulatory environment for cryptocurrencies, as institutional adoption of these currencies increases. Solana’s close ties with businesses will help it weather the halving’s fallout better than other currencies.

This will be especially true if 2026 is Solana’s first year without major outages, as the diverse network of blockchain clients helps keep the network running even if one client experiences an outage.

Accordingly, our Solana price forecast for 2026 is more optimistic than it might be for other coins. We expect:

- Potential high price for 2026: $424.23.

- Average price in 2026: $346.62

- Potential Lowest Price in 2026: $276.85

Solana Price Prediction 2027

As the global economy continues to recover from the recession fears that followed the pandemic, adoption of cryptocurrencies and blockchain networks for a variety of uses continues to grow, and regulatory frameworks around the world continue to improve in favor of cryptocurrencies.

As regulatory frameworks for cryptocurrencies evolve, 2027 could be the year decentralization becomes a major part of the cryptocurrency debate, as people become more confident in storing their money and conducting transactions on robust decentralized networks, while their trust in the current system dwindles.

Solana, with its centralized group of validators and history of maintaining close relationships with authorities, institutions, and major corporations, may not be in a good position when this debate begins. However, we don’t expect the token to suffer much, and it could even experience continued growth thanks to positive conditions in the broader cryptocurrency market.

We forecast the following prices for Solana in 2027:

- Potential high price for 2027: $567.86.

- Average price in 2027: $424.79.

- Possible Lowest Price in 2027: $308.03.

SOL Price Prediction 2028

As we look to the future of cryptocurrencies, the vision becomes less clear the further we go. However, we do know that 2028 will be the year of Bitcoin’s fifth halving. Will this impact other currencies, or will Bitcoin, as a digital alternative to gold, only grow when there is market instability while other currencies decline?

We expect the market impact of the halving to continue, but not as strongly as in previous years. Since 2028 is the year of the halving, a slight uptick is expected as more users seek to purchase a share of Bitcoin in anticipation of the next year’s halving.

Based on this, our Solana price prediction for 2028 is:

- Potential high price in 2028: $735.19.

- Average price for 2028: $508.08.

- Possible Lowest Price in 2028: $338.16

Solana Price Prediction 2029

With the Bitcoin halving the previous year and the continued growth of cryptocurrency adoption, the rising price of Bitcoin prompted users to start purchasing other layer-one and layer-two tokens in the ecosystem. Given the trend toward decentralization, Solana may not perform as well as its peers, but it is still climbing to new highs.

Our Solana price prediction for 2029 is as follows:

- Potential high price for 2029: $919.85.

- Average price for 2029: $592.83.

- Possible Lowest Price in 2029: $366.22

SOL Price Prediction 2023

If 2029 was the year we saw new record highs due to the Bitcoin halving, then 2030 will be the year when, as has happened before, the repercussions of these record highs unfold. However, with cryptocurrencies fully mainstreamed, the losses are much less than in previous halving events, helping to further stabilize prices.

Based on this, our Solana price prediction for 2030 is as follows:

- Potential high price for 2030: $1,111.22.

- Average price in 2030: $674.46.

- Possible Lowest Price in 2030: $391.22

Historical performance of Solana

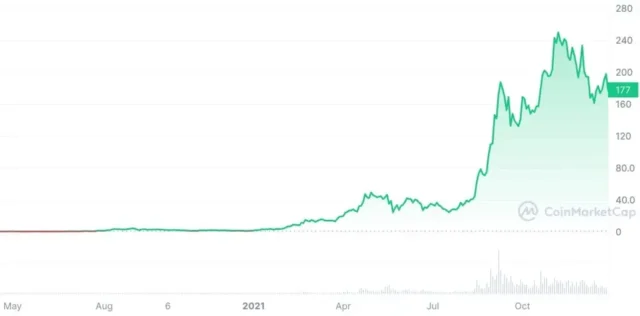

The Solana mainnet was launched on March 17, 2020, and the first Solana price data on CoinMarketCap dates back to April 10, 2020, when the token price was $0.9511.

From this point, the price declined to an all-time low of $0.5052 on May 11 and traded between $0.50 and $0.70 until July. In July, SOL began its ascent, surpassing $1 for the first time. As interest in the token and the network increased, SOL continued its upward climb, reaching its yearly peak of $4.4217 at the end of August.

The token then declined, finding temporary support at $2.50, before bottoming out at $1.3251 at the end of the year.

2021: SOL’s Rise

The cryptocurrency market entered a bull market in 2021, and Solana followed suit, rising from $1.8456 at the beginning of the year to a peak of $49.50 in early May, coinciding with Bitcoin’s first peak of $60,000. However, this represented a 2,582% increase and a staggering 11-fold increase from its previous year’s high.

SOL then stabilized in a trading range between $25 and $50 until mid-August, when it began to climb again. This climb slowed in early September with the first partial network outage, but it continued to climb, reaching a high of $187.61 before falling to $132, a decline that saw Solana’s first major outage on September 14, which lasted for 17 hours.

SOL price rebounded from this level and nearly doubled in value between then and the beginning of November, reaching an all-time high of $260.06 on November 6, coinciding with the peak of the entire crypto market.

From there, SOL’s price declined along with the rest of the crypto market, ending the year at $178.53.

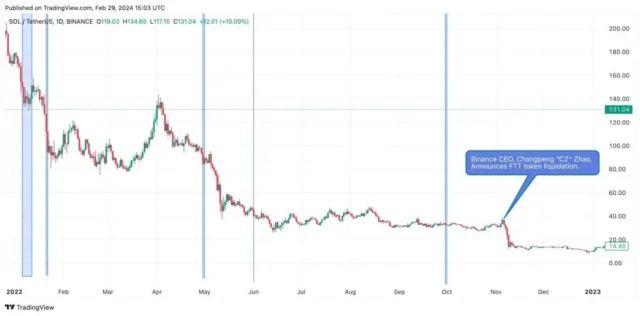

2022: A year of suffering for Solana

Solana declined in 2022 along with the rest of the cryptocurrency market after a Bitcoin halving-fueled rally. However, it also began the year with its own set of problems. In total, Solana experienced six major outages in January 2022, as well as three minor ones, resulting in a network uptime of 96.43%. All 2022 outages are highlighted in blue on the chart below.

While the price remained stable during the first week of the outages, it quickly declined once the network was back up and running properly. By the end of the month, Solana had lost 44% of its value and the price had fallen below $100 to $99.50.

Solana’s price then found support around $80 during February and March. In late March, amid a temporary upswing in the cryptocurrency market, SOL rose above $132 before falling back, falling below $40 in early June and finding support at $30 that same month.

SOL traded between $30 and $45 during the summer of 2022, moving into a narrower range between $30 and $35 in September.

In early November, the FTX collapse began after Binance CEO CZ announced that the exchange would liquidate its holdings of FTX’s FTT token on November 6.

SOL, which was backed and funded by FTX and Alameda Research and holds over 10% of the total SOL supply, was directly impacted by this announcement and lost over 60% of its value within 4 days.

SOL found support at $13 and then closed 2022 below $10, with a year-to-date loss of 94.4%.

However, in June, amid lawsuits against Binance and Coinbase, followed by a November lawsuit against Kraken, the U.S. Securities and Exchange Commission (SEC) classified SOL as a security. This classification caused SOL to lose 33% of its value in the following days, with the price falling below $15.

But then the token began to climb, briefly reaching above $25 in July before a false report of a Bitcoin ETF approval in mid-October sparked a market rally. The creation of the meme coin BONK—now the third-best meme coin on the market—sparked a meme-coin frenzy on the SOL network. Coinciding with the broader market rally, this helped propel SOL into the top 10 on CoinMarketCap, with SOL gaining 88% in December to reach a yearly high of $126.36.

Over the course of 2023, SOL saw a 997% increase, ending the year at $109.55.

With SOL’s return to the top 10, the coin became more susceptible to broader market volatility and followed the speculative market movements with the approval of a Bitcoin ETF. It struggled to break the psychological $100 barrier for a while, however, experiencing a five-hour blackout on February 6 without significant impact. Instead, it posted 24% gains over the next eight days, surpassing $100 for the first time in 2024.

The meme coin trading wave led SOL to reach a high of $202 on March 31, and SOL approached the $200 mark again in May and July. Solana has rarely dropped below $125 since March, indicating that the network is strengthening and that traders are stepping in to buy SOL rather than allowing it to drop to 2023 levels.

As of November 14, 2024, SOL is trading at $214.91, with a market cap of

What is Solana and what are its uses?

Solana is a third-generation, open-source blockchain designed for mass adoption thanks to its energy-efficient, fast, and low-cost nature. Solana uses a Proof-of-Stake model, which integrates with a Proof-of-History model to increase transaction verification speed and deliver sub-second finality to users.

The Solana network supports an ecosystem of smart contract-based decentralized applications, as well as digital tokens and NFTs, and can theoretically process over 700,000 transactions per second.

The Solana blockchain was first envisioned with the release of the first version of the Solana whitepaper in 2017 by Anatoly Yakovenko, in which he described how an accurate clock could dramatically simplify the synchronization process of a decentralized network, increasing its throughput to become limited only by the network’s bandwidth.

The project’s development began in collaboration with some former colleagues from Qualcomm, the telecommunications equipment and semiconductor company where Anatoly served as an executive. Initially, the project was called Loom, but later renamed Solana, after the town of Solana Beach, where several team members lived while working at Qualcomm.

Solana has evolved through several versions and demonstrated its transaction processing capabilities on multiple testnets before hosting an initial coin offering (ICO) in March 2020, followed by the mainnet launch that same month. Solana is developed by Solana Labs , and the ecosystem’s growth is overseen by the Solana Foundation.

How to buy Solana?

SOL is one of the most prominent coins in the cryptocurrency market and is available on most cryptocurrency exchanges. Despite being classified as a security by the U.S. Securities and Exchange Commission last year, exchanges around the world have remained unaffected and continue to offer it to users.

Although it is available on many platforms, we recommend purchasing SOL from Binance .

Frequently Asked Questions

Will Solana recover?

Yes, Solana has fully recovered from a disastrous 2022, increasing its value by nearly 1,000% in 2023 and another 45% in 2024. Many experts expect Solana’s recovery to continue through 2025.

Is Solana a good long-term investment?

Many experts suggest that Solana is a good long-term investment, given its high usage levels, cheap transactions, and extremely high throughput. However, some investors caution against frequent network outages, its classification as a security, and its high degree of centralization.

What are the risks and considerations of investing in Solana?

Risks investors should consider include frequent network outages, high market volatility, and the SEC’s classification as a security. Some blockchain experts also consider the network’s high centralization an additional challenge.

Could Solana Become the Next Bitcoin?

Despite Solana’s strong performance and remarkable progress since the 2022 lows, few experts expect Solana to follow Bitcoin’s path or reach its status.

What are the main features of Solana that make it unique?

Solana is characterized by its fast transaction execution speed and low costs, as it can process more than 700,000 transactions per second thanks to its “proof of history” technology, which increases processing efficiency.

What is the expected price of Solana in the coming years?

Solana is expected to reach new heights in the coming years, benefiting from the effects of the Bitcoin halving and the growing market for decentralized finance. However, these forecasts remain subject to change based on market performance and the regulatory environment.